The world of trading has witnessed unprecedented improvements in recent years, with engineering driving advancement at every turn. axiom's detailed suite of trading methods is a perfect exemplory instance of how engineering is reshaping the trading landscape. Developed to meet the needs of modern traders, Axiom methods harness information, analytics, and instinctive interfaces to deliver unmatched performance.

Sophisticated Data Analytics

At the heart of Axiom's providing is its cutting-edge information analytics engine. By control significant datasets in real time, Axiom gives traders with actionable insights to guide their decisions. These tools analyze historic styles, identify styles, and assess industry sentiment. The capability to accessibility such granular information empowers traders to make educated choices with precision, somewhat lowering the risks related to speculative trading.

Like, traders employing Axiom's tools can examine correlations between multiple areas or establish anomalies that indicate potential opportunities. That ability equips users with the equipment they need to keep forward in very volatile markets.

Spontaneous Trading Interfaces

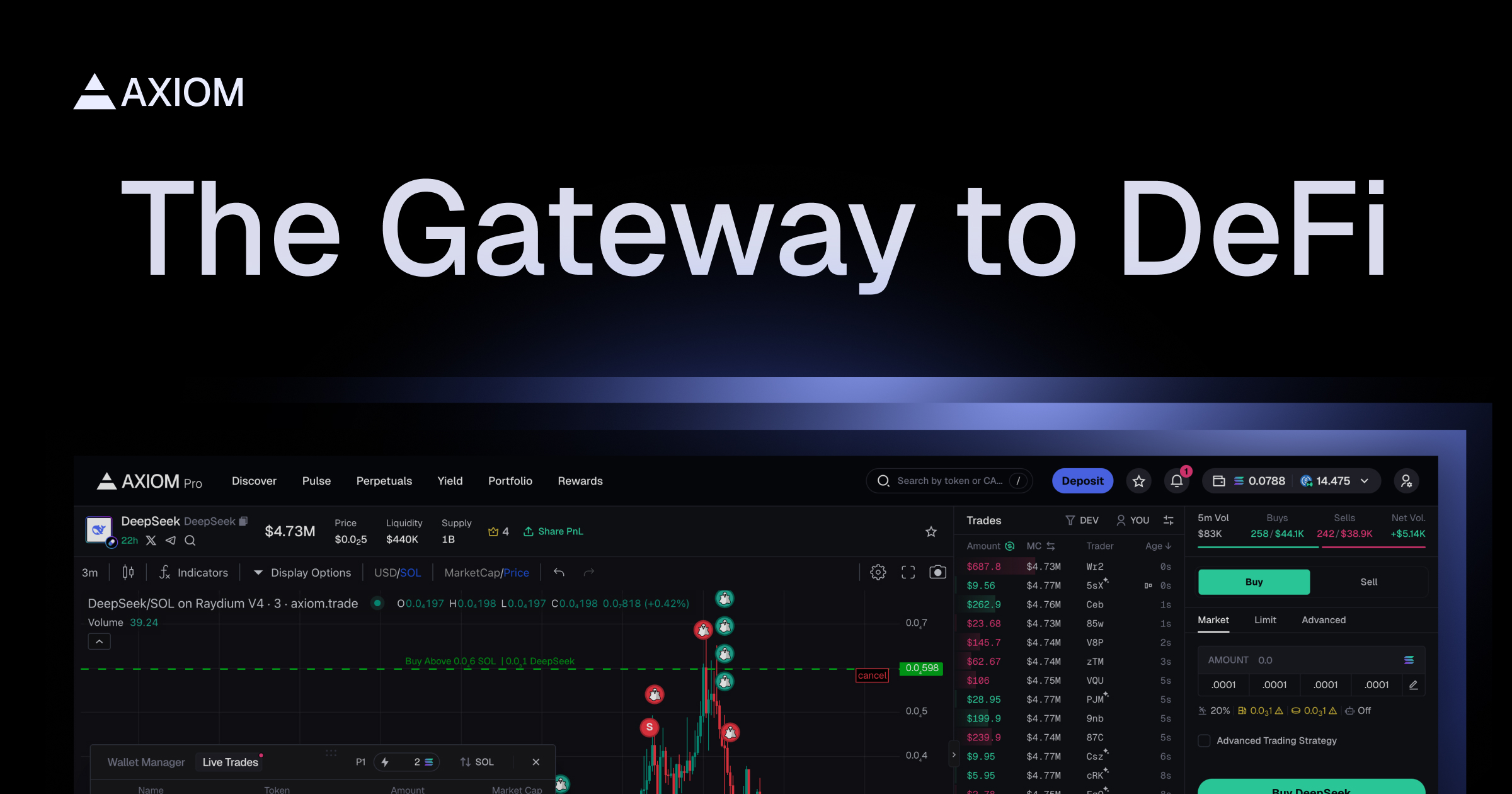

Axiom has dedicated substantial sources to ensuring its trading systems are as user-friendly since they are powerful. Unlike several programs that overwhelm people with excessive options and knowledge clog, Axiom offers a streamlined program created for efficiency.

The platform's custom-made dashboards let traders to tailor their workspace to match individual preferences. Functions like drag-and-drop widgets, one-click industry execution, and distinct real-time visualizations of market developments ensure traders can run swiftly without reducing accuracy. That intuitive style not just enhances output but additionally provides an increased trading experience.

Risk Management Resources

One of Axiom's most important benefits to contemporary trading is based on their revolutionary chance administration tools. Chance administration is essential in trading, wherever market changes can result in significant losses. With built-in risk evaluation functions, Axiom helps traders estimate possible losses and determine specific variables that assure trades align with predetermined risk threshold levels.

Furthermore, functions like stop-loss and take-profit adjustments instantly mitigate risks, giving traders reassurance in the face area of industry volatility.

A Varied Trading Environment

Axiom's power is based on their versatility. It supports numerous asset classes, including equities, forex, commodities, and cryptocurrencies. This diversity guarantees that traders may perform on a single program, lowering the trouble of handling multiple accounts across various systems.

The integration of Axiom's room with third-party APIs further strengthens its attraction, fostering easy relationships with other resources and services critical to trading success.

Axiom's room of trading instruments is not only a a reaction to growing market demands; it signifies a essential change toward better, data-driven trading. By blending sophisticated analytics, user-friendly design, and effective risk management, Axiom is setting new standards, ensuring traders of most knowledge levels can prosper in a competitive international market.